In my technical analysis of securities,I usually do a top down or bottom up analysis based on market conditions,but I will do a top-down analysis now.

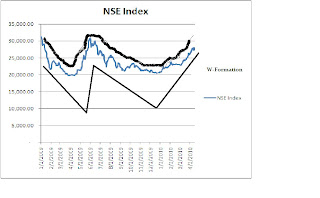

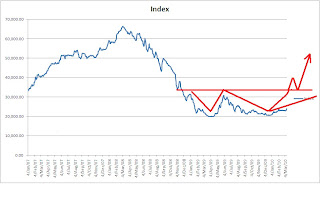

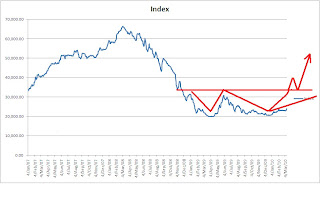

Looking at the NSE index I can say that the market is about resuming the up-trend,don't let us forget that the crash of the market was just a major retracement of the long term uptrend.

Reasons why I believe it is resuming up-trend:

-Formation of the W-formation(also called double bottom) which is a significant reversal pattern,I have highlighted it in the chart attached

-Since the index touched 20,000 as earlier said,subsequent swing lows has been higher(higher lows)

Targets:

-Confirmation of resumed up-trend is when the index is able to break 30,000.When it breaks 30,000 it will retrace before moving higher.

Please note:It will not be an easy ride the second bottom might be extended,but this is how it will look like when looking at the big picture,this analysis is for long term investment horizon,but we should get to 30,000 before the year runs out.

As earlier said,UNHOMES and AFRIBANK are very good stocks to buy now.

Humble regards.